What is a Cap Table?

When it comes to early stage fundraising, no question is too basic. Entrepreneurs are passionate about their companies. They are engineers, product gurus, visionaries and more. What they do not often have is a formal financial education or finance background. That’s totally okay. Entrepreneurs just need to be smart enough to find someone who can help them with this or know where to seek out answers. Understanding a company’s financials is important for every founder. I worked with a brilliant founder with an engineering background a few years ago. He and his co-founders had self-funded their SaaS company and were profitable and growing fast. A key customer of theirs, seeing the potential for the startup, came to them wanting to invest. One of the first things the customer/investor asked for was a cap table. The founder called me wanting to know how to respond. In very simple terms, here’s what what you need to know:

Cap Table 101

- Cap table is short for Capitalization Table. No one says “capitalization table”

- It is an Excel spreadsheet, in ledger form

- Every company needs to have one

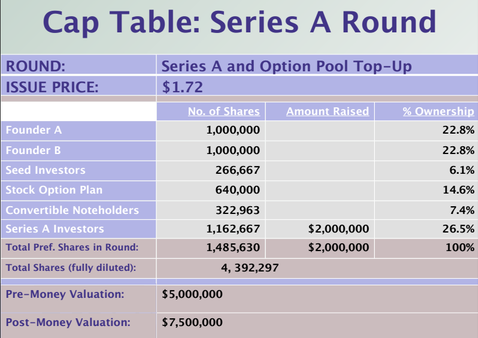

- It explains the ownership of a company

- Lists each shareholder and what he/she owns (common shares, preferred shares, warrants, options, notes or other debt)

- It is updated with details of each round of financing and the impact of the new investment on the current shareholders and the company’s financial structure

- It allows someone to calculate the impact of a new investment on everyone’s shares and explains the financial outcome of an exit

Why is this important? As a founder, investor, employee, one needs to know how different scenarios (strategic, financial, exits, … etc.) impact the company and one’s shares. More specifically, you want to know how much of the company you own and what it’s worth each step of the way.

My advice is to get it right from the start so that you don’t have to go back later on and redo it. Use a good, flexible framework that can accommodate your company’s growth regardless of how complicated additional rounds of financing get.